Here is the complete list of books published by Dave Ramsey, American author, personal money-management expert, and national radio personality.

Seven of Dave Ramsey’s books, Smart Money Smart Kids, The Legacy Journey, Dave Ramsey’s Complete Guide to Money, EntreLeadership, The Total Money Makeover, More Than Enough, and Financial Peace, have published more than 11 million copies combined.

Who Is Dave Ramsey?

Born on September 3, 1959 in Antioch, Tennessee, Dave Ramsey graduated from the College of Business Administration at University of Tennessee, Knoxville, where he earned a Bachelor of Science degree in Finance and Real Estate.

Ramsey worked as a real estate investor, doing business as Ramsey Investments, Inc. By age 26, he has already established a $4 million real estate portfolio.

However, the bank that was financing his business was sold to another bank who immediately demanded repayment on the total loan amount of his business. Because he was an able to pay, Ramsey eventually filed for bankruptcy in September 1988.

Ramsey was able to recover financially, and using his personal wisdom he gained during that time, he now devotes his life teaching others how to be financially responsible so they can earn enough to take care of their family, have a solid retirement plan, and still have extra to give generously to others.

In 1992, Ramsey founded the Lampo group, LLC to provide various means of financial counseling to anyone who wants to learn the principles of proper money management. 20 years later his company has grown to more than 800 members.

In 2014, the company was rebranded to become Ramsey solutions. His brand is now nationally recognized, but he said that his success is only defined by the number of lives he was able to change through his message.

Ramsey is also the creator of financial peace University. It is a program that helps people take control of their money and a master new behavioral principles that are founded on accountability and commitment.

Since its inception, more than 5 million people have attended Financial Peace University, Smart Money Smart Kids, and Legacy Journey classes at their community group, military base, church, there were places and even local nonprofit organizations.

Dave Ramsey has been married to his wife, Sharon, for more than 30 years now. They have three children and reside in Franklin, Tennessee.

Dave Ramsey Complete Booklist & Summary

Here is Dave Ramsey’s list of books along with a short summary:

1) Financial Peace – 1992

2) Dumping Debt: Breaking the Chains of Debt – 1993

- Book Reviews:

3) Financial Peace Planner – 1998

Book Summary: Get out of debt and stay out with the help of Dave Ramsey, the financial expert who has helped millions of Americans control their moneyThe Financial Peace Planner may be the most valuable purchase you ever make. Dave Ramey’s practical regimen, based on his own personal experience with debt, offers hard-won advice and much needed hope to people who find themselves in serious debt and desperate for a way out. This book comes in a workbook format, allowing you to frequently monitor your progress and, most importantly, to face your situation honestly. Loaded with inspirational insights that come from personal experience, this set of books will be life changing for any debt-ridden readers.You’ll find help on how to:

Book Summary: Get out of debt and stay out with the help of Dave Ramsey, the financial expert who has helped millions of Americans control their moneyThe Financial Peace Planner may be the most valuable purchase you ever make. Dave Ramey’s practical regimen, based on his own personal experience with debt, offers hard-won advice and much needed hope to people who find themselves in serious debt and desperate for a way out. This book comes in a workbook format, allowing you to frequently monitor your progress and, most importantly, to face your situation honestly. Loaded with inspirational insights that come from personal experience, this set of books will be life changing for any debt-ridden readers.You’ll find help on how to:

• Assess the urgency of your situation

• Understand where your money’s going

• Create a realistic budget

• Dump your debt

• Clean up your credit rating- Book Reviews:

4) More than Enough – 1998

Book Summary: In his first best seller, Financial Peace, Dave Ramsey taught us how to eliminate debt from our lives. Now in More Than Enough, he gives us the keys to building wealth while also creating a successful, united family. Drawing from his years of work with thousands of families and corporate employees, Ramsey presents the ten keys that guarantee family and financial peace, including: values, goals, patience, discipline, and giving back to one’s community. Using these essential steps anyone can create prosperity, live debt-free, and achieve marital bliss around the issue of finances. Filled with stories of couples, single men and women, children, and single parents, More Than Enough will show you:

Book Summary: In his first best seller, Financial Peace, Dave Ramsey taught us how to eliminate debt from our lives. Now in More Than Enough, he gives us the keys to building wealth while also creating a successful, united family. Drawing from his years of work with thousands of families and corporate employees, Ramsey presents the ten keys that guarantee family and financial peace, including: values, goals, patience, discipline, and giving back to one’s community. Using these essential steps anyone can create prosperity, live debt-free, and achieve marital bliss around the issue of finances. Filled with stories of couples, single men and women, children, and single parents, More Than Enough will show you:

- How to create a budget that fits your income and creates wealth

- What finances and romance have to do with one another

- What role values play in your financial life

- How to retire wealthy in every way

- And much, much more

Resonating with Ramsey’s down-home, folksy voice, heartwarming case histories, inspiring insights, quotations from the Bible, and exercises, quizzes, and worksheets, More Than Enough provides an inspiring wealth-building guide and a life-changing blueprint for a vital family dynamic.

- Book Reviews:

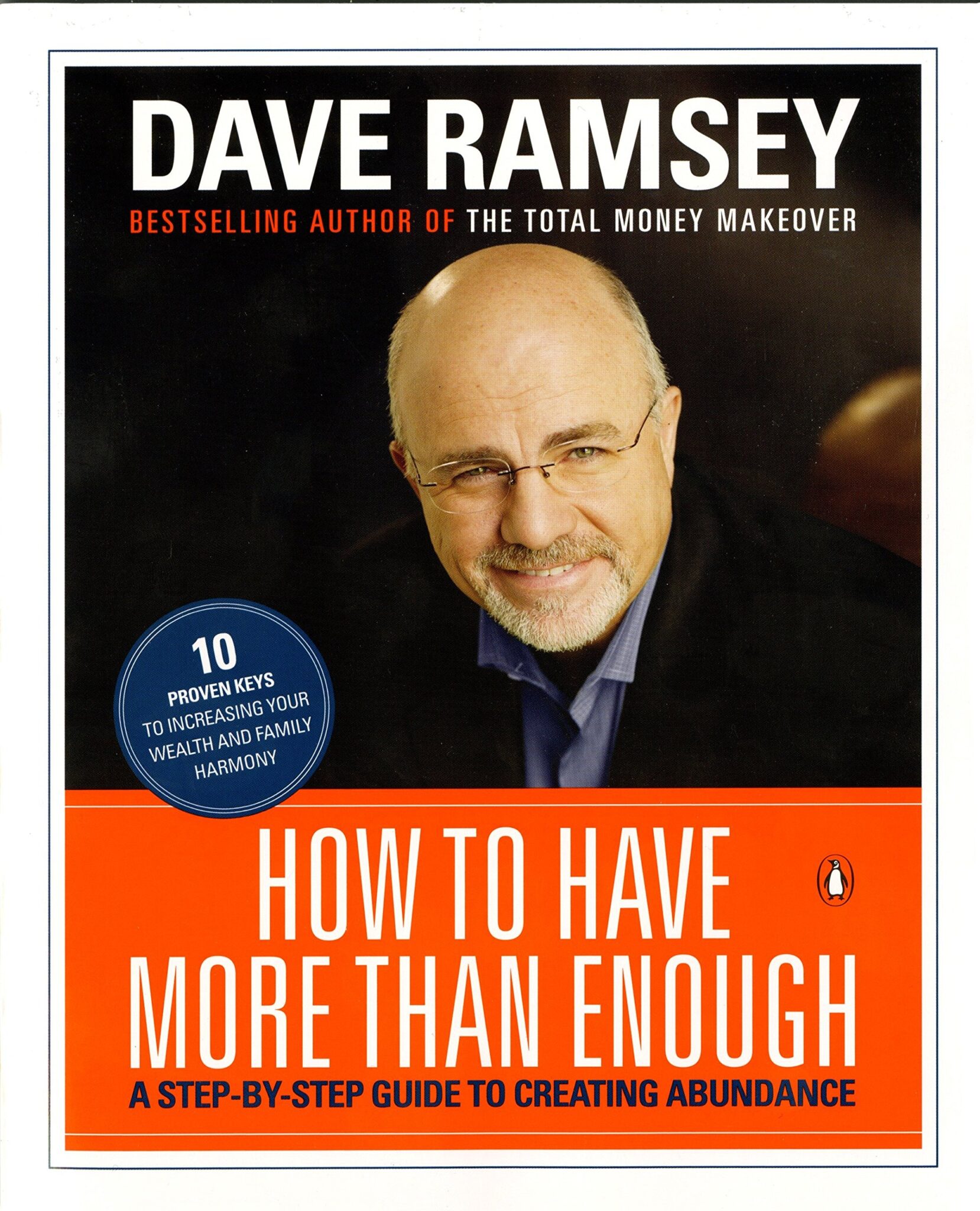

5) How to Have More Than Enough: A Step-By-Step Guide to Creating Abundance – 2000

Book Summary: Let the author of Financial Peace guide you and your family down the road to success with this companion to the bestselling More than EnoughIn Financial Peace, Dave Ramsey showed readers how to get out of debt. Now he uses the same blend of down-home wisdom and straight talk to take readers to the next step: building wealth. But success means more than money–it means having a happy marriage and family. In How to Have More Than Enough, Dave Ramsey guides readers down the path to true success.Rather than gimmicks or quick fixes, Ramsey’s method for achieving financial and familial stability focuses on ten traits essential to creating prosperity, teaching children about money, living debt-free, and achieving marital bliss when it comes to finances. His easy-to-follow workbook illustrates each of these traits and allows readers to frequently assess their progress and honestly evaluate their situation. How to Have More Than Enough offers readers and their spouses the chance to work toward building wealth and strengthening their families.

Book Summary: Let the author of Financial Peace guide you and your family down the road to success with this companion to the bestselling More than EnoughIn Financial Peace, Dave Ramsey showed readers how to get out of debt. Now he uses the same blend of down-home wisdom and straight talk to take readers to the next step: building wealth. But success means more than money–it means having a happy marriage and family. In How to Have More Than Enough, Dave Ramsey guides readers down the path to true success.Rather than gimmicks or quick fixes, Ramsey’s method for achieving financial and familial stability focuses on ten traits essential to creating prosperity, teaching children about money, living debt-free, and achieving marital bliss when it comes to finances. His easy-to-follow workbook illustrates each of these traits and allows readers to frequently assess their progress and honestly evaluate their situation. How to Have More Than Enough offers readers and their spouses the chance to work toward building wealth and strengthening their families.

- Book Reviews:

6) Financial Peace Junior: Teaching Kids How to Win With Money! – 2000

Book Summary: Financial Peace Junior is designed to help you teach your kids about money. It’s packed with tools, resources and step-by-step instructions for parents. What can be intimidating is made ultra-easy. There are ideas for activities and age-appropriate chores, and you’ll have all the tools you need to make learning about money a part of your daily life. Your kids will love the exciting games and toys. The lessons of working, giving, saving and spending are brought to life through fun stories in the activity book, and kids will love tracking their progress on the dry-erase boards! Financial Peace Junior doesn’t just give you the tools to teach your kids to win with money―it shows you how.

Book Summary: Financial Peace Junior is designed to help you teach your kids about money. It’s packed with tools, resources and step-by-step instructions for parents. What can be intimidating is made ultra-easy. There are ideas for activities and age-appropriate chores, and you’ll have all the tools you need to make learning about money a part of your daily life. Your kids will love the exciting games and toys. The lessons of working, giving, saving and spending are brought to life through fun stories in the activity book, and kids will love tracking their progress on the dry-erase boards! Financial Peace Junior doesn’t just give you the tools to teach your kids to win with money―it shows you how.

- Book Reviews:

7) Pricele$$: Straight-shooting No-frills Financial Wisdom – 2002

Book Summary: What would you call a book that offered proven tips to dumping debt, managing money, and was actually fun to read? We call it Priceless – and it’s the brand new book by New York Times best-selling author, with over 1,000,000 books in print, and nationally syndicated radio host, Dave Ramsey.As Dave says, “broke is normal… so let’s all get weird!” In this compact gift book, he shows you just how to do that with a revolutionary message that has literally changed millions of lives. It’s a message of both hope and empowerment. According to Dave, “You can have financial peace.” You can live debt free. You can have more than enough… but not until you recognize some basic principles about how you save, spend, and use your money.”This is the perfect book for those just starting out on their own as well as those who’ve struggled with money their entire lives. One thing’s for certain – Dave will make the journey fun and unpredictable as he completely changes your approach to money… and that’s Priceless!

Book Summary: What would you call a book that offered proven tips to dumping debt, managing money, and was actually fun to read? We call it Priceless – and it’s the brand new book by New York Times best-selling author, with over 1,000,000 books in print, and nationally syndicated radio host, Dave Ramsey.As Dave says, “broke is normal… so let’s all get weird!” In this compact gift book, he shows you just how to do that with a revolutionary message that has literally changed millions of lives. It’s a message of both hope and empowerment. According to Dave, “You can have financial peace.” You can live debt free. You can have more than enough… but not until you recognize some basic principles about how you save, spend, and use your money.”This is the perfect book for those just starting out on their own as well as those who’ve struggled with money their entire lives. One thing’s for certain – Dave will make the journey fun and unpredictable as he completely changes your approach to money… and that’s Priceless!

- Book Reviews:

8) Cash Flow Planning: The Nuts and Bolts of Budgeting – 2002

Book Summary: Li’l Petey gets caught in some family drama in the eighth Dog Man book from worldwide bestselling author and artist Dav Pilkey.Petey the Cat is out of jail, and he has a brand-new lease on life. While Petey’s reevaluated what matters most, Li’l Petey is struggling to find the good in the world. Can Petey and Dog Man stop fighting like cats and dogs long enough to put their paws together and work as a team? They need each other now more than ever — Li’l Petey (and the world) is counting on them!Dav Pilkey’s wildly popular Dog Man series appeals to readers of all ages and explores universally positive themes, including empathy, kindness, persistence, and the importance of doing good.

Book Summary: Li’l Petey gets caught in some family drama in the eighth Dog Man book from worldwide bestselling author and artist Dav Pilkey.Petey the Cat is out of jail, and he has a brand-new lease on life. While Petey’s reevaluated what matters most, Li’l Petey is struggling to find the good in the world. Can Petey and Dog Man stop fighting like cats and dogs long enough to put their paws together and work as a team? They need each other now more than ever — Li’l Petey (and the world) is counting on them!Dav Pilkey’s wildly popular Dog Man series appeals to readers of all ages and explores universally positive themes, including empathy, kindness, persistence, and the importance of doing good.

- Book Reviews:

9) Total Money Makeover – 2003

Book Summary: New York Times bestseller! More than Five million copies sold!You CAN take control of your money. Build up your money muscles with America’s favorite finance coach.Okay, folks, do you want to turn those fat and flabby expenses into a well-toned budget? Do you want to transform your sad and skinny little bank account into a bulked-up cash machine? Then get with the program, people. There’s one sure way to whip your finances into shape, and that’s with The Total Money Makeover: Classic Edition.By now, you’ve heard all the nutty get-rich-quick schemes, the fiscal diet fads that leave you with a lot of kooky ideas but not a penny in your pocket. Hey, if you’re tired of the lies and sick of the false promises, take a look at this—it’s the simplest, most straightforward game plan for completely making over your money habits. And it’s based on results, not pie-in-the-sky fantasies. With The Total Money Makeover: Classic Edition, you’ll be able to:

Book Summary: New York Times bestseller! More than Five million copies sold!You CAN take control of your money. Build up your money muscles with America’s favorite finance coach.Okay, folks, do you want to turn those fat and flabby expenses into a well-toned budget? Do you want to transform your sad and skinny little bank account into a bulked-up cash machine? Then get with the program, people. There’s one sure way to whip your finances into shape, and that’s with The Total Money Makeover: Classic Edition.By now, you’ve heard all the nutty get-rich-quick schemes, the fiscal diet fads that leave you with a lot of kooky ideas but not a penny in your pocket. Hey, if you’re tired of the lies and sick of the false promises, take a look at this—it’s the simplest, most straightforward game plan for completely making over your money habits. And it’s based on results, not pie-in-the-sky fantasies. With The Total Money Makeover: Classic Edition, you’ll be able to:

- Design a sure-fire plan for paying off all debt—meaning cars, houses, everything

- Recognize the 10 most dangerous money myths (these will kill you)

- Secure a big, fat nest egg for emergencies and retirement!

Includes new, expanded “Dave Rants” sidebars tackle marriage conflict, college debt, and more. All-new forms and back-of-the-book resources to make Total Money Makeover a reality.

Dive deeper into Dave’s game plan with The Total Money Makeover Workbook: Classic Edition. The Total Money Makeover: Classic Edition is also available in Spanish, transformación total de su dinero.

- Book Reviews:

10) The Big Birthday Surprise: Junior Discovers Giving – 2003

Book Summary: You’re invited to Junior’s birthday party! Come learn what his big birthday surprise is and how Junior learns a lesson about giving to others on his special day.In The Big Birthday Surprise, Junior learns about giving. This story teaches children about the many ways to give to others, not only with their money but also with their time.This book is illustrated by award-winning cartoonist Marshall Ramsey.Recommended for kids ages 3-10.

Book Summary: You’re invited to Junior’s birthday party! Come learn what his big birthday surprise is and how Junior learns a lesson about giving to others on his special day.In The Big Birthday Surprise, Junior learns about giving. This story teaches children about the many ways to give to others, not only with their money but also with their time.This book is illustrated by award-winning cartoonist Marshall Ramsey.Recommended for kids ages 3-10.

- Book Reviews:

11) The Super Red Racer: Junior Discovers Work – 2003

Book Summary: Junior really, really wants an awesome new bike, but he doesn’t have the money to buy it. So, what does he do? He goes to work to earn the money!In The Super Red Racer, Junior learns about the rewards of hard work. This story teaches children the value of working hard to earn money instead of just expecting people to hand it to them.This book is illustrated by award-winning cartoonist Marshall Ramsey.Recommended for kids ages 3-10.

Book Summary: Junior really, really wants an awesome new bike, but he doesn’t have the money to buy it. So, what does he do? He goes to work to earn the money!In The Super Red Racer, Junior learns about the rewards of hard work. This story teaches children the value of working hard to earn money instead of just expecting people to hand it to them.This book is illustrated by award-winning cartoonist Marshall Ramsey.Recommended for kids ages 3-10.

- Book Reviews:

12) The Great Misunderstanding: Unleashing the Power of Generous Giving – 2003

- Book Reviews:

13) My Fantastic Field Trip – 2003

Book Summary: A cleverly illustrated book that takes Junior on a field trip that helps him to discover the value of saving.

Book Summary: A cleverly illustrated book that takes Junior on a field trip that helps him to discover the value of saving.

- Book Reviews:

14) Careless at the Carnival: Junior Discovers Spending – 2003

Book Summary: Off to the carnival – the land of cotton candy, corn dogs, dizzy rides and lots of fun! Junior and his friends learn the hard way how it’s not wise – or fun – to spend all their money all at once.In Careless at the Carnival, Junior learns about spending. This story teaches children the benefits of planning their spending and sticking to the plan, no matter what!This book is illustrated by award-winning cartoonist Marshall Ramsey.Recommended for kids ages 3-10.

Book Summary: Off to the carnival – the land of cotton candy, corn dogs, dizzy rides and lots of fun! Junior and his friends learn the hard way how it’s not wise – or fun – to spend all their money all at once.In Careless at the Carnival, Junior learns about spending. This story teaches children the benefits of planning their spending and sticking to the plan, no matter what!This book is illustrated by award-winning cartoonist Marshall Ramsey.Recommended for kids ages 3-10.

- Book Reviews:

15) The Money Answer Book – 2004

Book Summary: This question and answer book is the perfect resource guide for equipping individuals with key information about everyday money matters.Questions and answers deal with 100+ of the most-asked questions from The Dave Ramsey Show—everything from budget planning to retirement planning or personal buying matters, to saving for college and charitable giving. This is Dave in his most popular format—ask a specific question, get a specific answer.

Book Summary: This question and answer book is the perfect resource guide for equipping individuals with key information about everyday money matters.Questions and answers deal with 100+ of the most-asked questions from The Dave Ramsey Show—everything from budget planning to retirement planning or personal buying matters, to saving for college and charitable giving. This is Dave in his most popular format—ask a specific question, get a specific answer.

- Book Reviews:

16) Total Money Makeover Workbook – 2004

Book Summary: New York Times best seller! More than five million copies sold!*You CAN take control of your money. Build up your money muscles with America’s favorite finance coach.Okay, folks, do you want to turn those fat and flabby expenses into a well-toned budget? Do you want to transform your sad and skinny little bank account into a bulked-up cash machine? Then get with the program, people. There’s one sure way to whip your finances into shape, and that’s with The Total Money Makeover: Classic Edition.By now, you’ve heard all the nutty get-rich-quick schemes, the fiscal diet fads that leave you with a lot of kooky ideas but not a penny in your pocket. Hey, if you’re tired of the lies and sick of the false promises, take a look at this—it’s the simplest, most straightforward game plan for completely making over your money habits. And it’s based on results, not pie-in-the-sky fantasies. With The Total Money Makeover: Classic Edition, you’ll be able to:

Book Summary: New York Times best seller! More than five million copies sold!*You CAN take control of your money. Build up your money muscles with America’s favorite finance coach.Okay, folks, do you want to turn those fat and flabby expenses into a well-toned budget? Do you want to transform your sad and skinny little bank account into a bulked-up cash machine? Then get with the program, people. There’s one sure way to whip your finances into shape, and that’s with The Total Money Makeover: Classic Edition.By now, you’ve heard all the nutty get-rich-quick schemes, the fiscal diet fads that leave you with a lot of kooky ideas but not a penny in your pocket. Hey, if you’re tired of the lies and sick of the false promises, take a look at this—it’s the simplest, most straightforward game plan for completely making over your money habits. And it’s based on results, not pie-in-the-sky fantasies. With The Total Money Makeover: Classic Edition, you’ll be able to:

- Design a sure-fire plan for paying off all debt—meaning cars, houses, everything

- Recognize the 10 most dangerous money myths (these will kill you)

- Secure a big, fat nest egg for emergencies and retirement!

Includes new, expanded “Dave Rants” sidebars tackle marriage conflict, college debt, and more. All-new forms and back-of-the-book resources to make Total Money Makeover a reality.

Dive deeper into Dave’s game plan with The Total Money Makeover Workbook: Classic Edition. The Total Money Makeover: Classic Edition is also available in Spanish, transformación total de su dinero.

- Book Reviews:

17) Adventures in Space: Junior Discovers Contentment – 2005

- Book Reviews:

18) Battle of the Chores – 2005

Book Summary: When you were a kid, did you ever borrow money from your brother or sister? Did they make your life miserable until you paid them back? In Battle of the Chores, Junior learns that being in debt to someone is not fun. This story teaches your child the value of working for money and the disadvantages of borrowing money. It will introduce them that the borrower is servant to the lender. Recommended for kids ages 3-10.

Book Summary: When you were a kid, did you ever borrow money from your brother or sister? Did they make your life miserable until you paid them back? In Battle of the Chores, Junior learns that being in debt to someone is not fun. This story teaches your child the value of working for money and the disadvantages of borrowing money. It will introduce them that the borrower is servant to the lender. Recommended for kids ages 3-10.

- Book Reviews:

19) A Special Thank You: Junior Discovers Integrity – 2005

Book Summary: When you were a kid, did you daydream about finding a bunch of money and imagine all the things you could buy with it? What would you have done if the money you found actually belonged to someone else? In A Special Thank You, Junior learns what it means to have integrity. This story teaches children the value of doing what is right, even though they may be tempted to do otherwise. This book is illustrated by award-winning cartoonist Marshall Ramsey. Recommended for kids ages 3-10.

Book Summary: When you were a kid, did you daydream about finding a bunch of money and imagine all the things you could buy with it? What would you have done if the money you found actually belonged to someone else? In A Special Thank You, Junior learns what it means to have integrity. This story teaches children the value of doing what is right, even though they may be tempted to do otherwise. This book is illustrated by award-winning cartoonist Marshall Ramsey. Recommended for kids ages 3-10.

- Book Reviews:

20) The Total Money Training Plan: Getting Started on a Life of Financial Fitness – 2006

- Book Reviews:

21) The Total Money Makeover Journal – 2007

Book Summary: You CAN take control of your money. Build up your money muscles with America’s favorite finance coach.Okay, folks, do you want to turn those fat and flabby expenses into a well-toned budget? Do you want to transform your sad and skinny little bank account into a bulked-up cash machine? Then get with the program, people. There’s one sure way to whip your finances into shape, and that’s with The Total Money Makeover: Classic Edition.By now, you’ve heard all the nutty get-rich-quick schemes, the fiscal diet fads that leave you with a lot of kooky ideas but not a penny in your pocket. Hey, if you’re tired of the lies and sick of the false promises, take a look at this—it’s the simplest, most straightforward game plan for completely making over your money habits. And it’s based on results, not pie-in-the-sky fantasies. With The Total Money Makeover: Classic Edition, you’ll be able to: Design a sure-fire plan for paying off all debt—meaning cars, houses, everything Recognize the 10 most dangerous money myths (these will kill you) Secure a big, fat nest egg for emergencies and retirement!Includes new, expanded “Dave Rants” sidebars tackle marriage conflict, college debt, and more. All-new forms and back-of-the-book resources to make Total Money Makeover a reality.Dive deeper into Dave’s game plan with The Total Money Makeover Workbook: Classic Edition. The Total Money Makeover: Classic Edition is also available in Spanish, transformación total de su dinero.

Book Summary: You CAN take control of your money. Build up your money muscles with America’s favorite finance coach.Okay, folks, do you want to turn those fat and flabby expenses into a well-toned budget? Do you want to transform your sad and skinny little bank account into a bulked-up cash machine? Then get with the program, people. There’s one sure way to whip your finances into shape, and that’s with The Total Money Makeover: Classic Edition.By now, you’ve heard all the nutty get-rich-quick schemes, the fiscal diet fads that leave you with a lot of kooky ideas but not a penny in your pocket. Hey, if you’re tired of the lies and sick of the false promises, take a look at this—it’s the simplest, most straightforward game plan for completely making over your money habits. And it’s based on results, not pie-in-the-sky fantasies. With The Total Money Makeover: Classic Edition, you’ll be able to: Design a sure-fire plan for paying off all debt—meaning cars, houses, everything Recognize the 10 most dangerous money myths (these will kill you) Secure a big, fat nest egg for emergencies and retirement!Includes new, expanded “Dave Rants” sidebars tackle marriage conflict, college debt, and more. All-new forms and back-of-the-book resources to make Total Money Makeover a reality.Dive deeper into Dave’s game plan with The Total Money Makeover Workbook: Classic Edition. The Total Money Makeover: Classic Edition is also available in Spanish, transformación total de su dinero.

- Book Reviews:

22) Relating With Money: Nerds and Free Spirits Unite! – 2008

- Book Reviews:

23) Dave Ramsey’s Complete Guide to Money – 2011

Book Summary: If you’re looking for practical information to answer all your “How?” “What?” and “Why?” questions about money, this book is for you. Dave Ramsey’s Complete Guide to Money covers the A to Z of Dave’s money teaching, including how to budget, save, dump debt, and invest. You’ll also learn all about insurance, mortgage options, marketing, bargain hunting and the most important element of all―giving.This is the handbook of Financial Peace University. If you’ve already been through Dave’s nine-week class, you won’t find much new information in this book. This book collects a lot of what he’s been teaching in FPU classes for 20 years, so if you’ve been through class, you’ve already heard it! It also covers the Baby Steps Dave wrote about in The Total Money Makeover, and trust us―the Baby Steps haven’t changed a bit. So if you’ve already memorized everything Dave’s ever said about money, you probably don’t need this book. But if you’re new to this stuff or just want the all-in-one resource for your bookshelf, this is it!

Book Summary: If you’re looking for practical information to answer all your “How?” “What?” and “Why?” questions about money, this book is for you. Dave Ramsey’s Complete Guide to Money covers the A to Z of Dave’s money teaching, including how to budget, save, dump debt, and invest. You’ll also learn all about insurance, mortgage options, marketing, bargain hunting and the most important element of all―giving.This is the handbook of Financial Peace University. If you’ve already been through Dave’s nine-week class, you won’t find much new information in this book. This book collects a lot of what he’s been teaching in FPU classes for 20 years, so if you’ve been through class, you’ve already heard it! It also covers the Baby Steps Dave wrote about in The Total Money Makeover, and trust us―the Baby Steps haven’t changed a bit. So if you’ve already memorized everything Dave’s ever said about money, you probably don’t need this book. But if you’re new to this stuff or just want the all-in-one resource for your bookshelf, this is it!

- Book Reviews:

24) EntreLeadership: 20 Years of Practical Business Wisdom from the Trenches – 2011

Book Summary: If you’re at all responsible for your company’s success, you can’t just be a hard-charging entrepreneur or a motivating, encouraging leader. You have to be both!If you’re at all responsible for your company’s success, you can’t just be a hard-charging entrepreneur or a motivating, encouraging leader. You have to be both!This book presents Dave’s playbook for creating work that matters; building an incredible group of passionate, empowered team members; and winning the race with steady momentum that will roll over any obstacle.Regardless of your business goals, you’ll discover that anyone can lead any venture to unbelievable growth and prosperity through Dave’s common sense, counterculture, EntreLeadership principles!

Book Summary: If you’re at all responsible for your company’s success, you can’t just be a hard-charging entrepreneur or a motivating, encouraging leader. You have to be both!If you’re at all responsible for your company’s success, you can’t just be a hard-charging entrepreneur or a motivating, encouraging leader. You have to be both!This book presents Dave’s playbook for creating work that matters; building an incredible group of passionate, empowered team members; and winning the race with steady momentum that will roll over any obstacle.Regardless of your business goals, you’ll discover that anyone can lead any venture to unbelievable growth and prosperity through Dave’s common sense, counterculture, EntreLeadership principles!

- Book Reviews:

25) Smart Money Smart Kids – 2014

Book Summary:Dave Ramsey and Rachel Cruze teach parents how to raise money-smart kids in a debt-filled world.In Smart Money Smart Kids, financial expert and best-selling author Dave Ramsey and his daughter Rachel Cruze equip parents to teach their children how to win with money. Starting with the basics like working, spending, saving, and giving, and moving into more challenging issues like avoiding debt for life, paying cash for college, and battling discontentment, Dave and Rachel present a no-nonsense, common-sense approach for changing your family tree.

Book Summary:Dave Ramsey and Rachel Cruze teach parents how to raise money-smart kids in a debt-filled world.In Smart Money Smart Kids, financial expert and best-selling author Dave Ramsey and his daughter Rachel Cruze equip parents to teach their children how to win with money. Starting with the basics like working, spending, saving, and giving, and moving into more challenging issues like avoiding debt for life, paying cash for college, and battling discontentment, Dave and Rachel present a no-nonsense, common-sense approach for changing your family tree.

- Book Reviews:

26) The Legacy Journey: A Radical View of Biblical Wealth and Generosity – 2014

Book Summary: What does the Bible really say about money? About wealth? How much does God expect you to give to others? How does wealth affect your friendships, marriage, and children? How much is “enough”?There’s a lot of bad information in our culture today about wealth—and the wealthy. Worse, there’s a growing backlash in America against our most successful citizens. But why? To many, wealth is seen as the natural result of hard work and wise money management. To others, wealth is viewed as the ultimate, inexcusable sin. This has left many godly men and women confused about what to do with the resources God has put in their care. They were able to build wealth using God’s ways of handling money, but then they are left feeling guilty about it. Is this what God had in mind?The Legacy Journey takes you deep into God’s Word, revealing His perspective on wealth, your personal and family legacy, and how He wants to use you to further His kingdom work around the world. You can truly live—and leave—a legacy. The journey starts today.

Book Summary: What does the Bible really say about money? About wealth? How much does God expect you to give to others? How does wealth affect your friendships, marriage, and children? How much is “enough”?There’s a lot of bad information in our culture today about wealth—and the wealthy. Worse, there’s a growing backlash in America against our most successful citizens. But why? To many, wealth is seen as the natural result of hard work and wise money management. To others, wealth is viewed as the ultimate, inexcusable sin. This has left many godly men and women confused about what to do with the resources God has put in their care. They were able to build wealth using God’s ways of handling money, but then they are left feeling guilty about it. Is this what God had in mind?The Legacy Journey takes you deep into God’s Word, revealing His perspective on wealth, your personal and family legacy, and how He wants to use you to further His kingdom work around the world. You can truly live—and leave—a legacy. The journey starts today.

- Book Reviews:

27) Junior’s Adventures: Storytime Book Set: Teaching Kids How to Win with Money! – 2015

Book Summary: Your children can join Junior in these six fun-filled adventures! Transform their futures with these colorful and entertaining books by teaching them how to handle money now.From working and saving to giving and spending, these wonderful stories will teach your kids real-life lessons, and the stories are so much fun that your children won’t even know they’re learning!Recommended for kids ages 3–10.What Books Are In the Junior’s Adventures: Storytime Book Set?

Book Summary: Your children can join Junior in these six fun-filled adventures! Transform their futures with these colorful and entertaining books by teaching them how to handle money now.From working and saving to giving and spending, these wonderful stories will teach your kids real-life lessons, and the stories are so much fun that your children won’t even know they’re learning!Recommended for kids ages 3–10.What Books Are In the Junior’s Adventures: Storytime Book Set?

- The Super Red Racer (Work)

- Careless at the Carnival (Spending)

- The Big Birthday Surprise (Giving)

- My Fantastic Fieldtrip (Saving)

- The Big Pay-Off (Integrity)

- Battle of the Chores (Debt)

- Book Reviews:

28) Summary of the Total Money Makeover – 2016

Book Summary: Total Money Makeover- SummaryGenius Reads offers an in-depth look into the popular novel by Dave Ramsey “Total Money Makeover”

Book Summary: Total Money Makeover- SummaryGenius Reads offers an in-depth look into the popular novel by Dave Ramsey “Total Money Makeover”

so you can appreciate it even more!It contains many tantalizing sections such as:

-Chapter by Chapter Summary

-Trivia Questions and moreDownload and start reading immediately !!* Note This is an unofficial companion book of Dave Ramsey popular book “Total Money Makeover”

– it is meant to enhance your reading experience and is not the original book.SUMMARY OF THE TOTAL MONEY MAKEOVER BY DAVE RAMSEY. Money, the want for money, and money-related issues are universal. Trying to develop a budget that suits one’s individual needs and is workable enough to actually stick to is a very common problem. All of us, at some point in our lives, face money-related issues. Sometimes, it is not enough to fulfill our financial goals. At other times, we don’t know how to save ourselves from going bankrupt. Having a smoothly working budget is the best answer to all money-related issues.

My husband and I just went through a really tough financial patch. With a new baby and all related expenses, we were really living hand to mouth. Rather than adding money to our savings, we were spending our savings quickly. We were very close to having a zero balance in our savings account when we realized that it was time for a lifestyle change, which is really what most budgets require.

We had to make several different major steps to get on a budget. We never realized what difference not picking up that party pack of chips from the store aisle could make. No one ever does until they try it. Shifting to a low-rent apartment, letting go of our Toyota Camry and resorting to public transport, quitting trips to fast food outlets, leaving the six-pack of beer back at the store counter, choosing a cheaper diaper brand, and shopping for our clothes at the wholesale store are some of the many changes that we had to make.

We also developed a habit to note each and every expense, down to the last penny. I downloaded budgeting software and logged each and every detail of income and expense into it. We started doing things for fun that didn’t require money. For date night, we would go for a walk around the park. By the way, we didn’t hire a babysitter; my husband’s mom took the baby for a few hours.

Long story short, within a few months, we were finally able to actually see our savings reading a comfortable figure. We plan to go on until we are completely free of financial anxiety. That is, we want to save enough so that we can have the mental and financial freedom to do things that we want and to fulfill our long-term financial goals. Then, savings can take care of the bills.

While I was planning our budget, I did a lot of research. This book is based on that research and some personal experiences that I gained while going through the process. The first chapter is purely theoretical. Chapter 2 contains several budgeting methods and psychological tactics that can help you stay on the budget. Chapter 3 contains a practical, step-wise plan that you can follow to develop your personalized budget.

I can assure you that if you follow the methods and techniques that I have provided in this book, you will be able to save yourself from a financial disaster, and you will be able to have a savings account statement that you are proud of.

- Book Reviews:

Conclusion

Love these books of Dave Ramsey? If you are looking for another author, book series or even genre to read next then check out our collection of must reads here.